On March 24th, the Venture Capital Association of Alberta (VCAA) and the Canadian Venture Capital and Private Equity Association (CVCA) announced that Alberta was awarded an honourable mention for reporting $455 million in VC investment, which is a record for the province. This amount solidified the province’s 4th place position in the country, as they captured just over 10% of the $4.4 billion total dollars invested into 509 VC deals. Tailwind Ventures believes this to be a pivotal time for the Albertan investing ecosystem as we support early-stage entrepreneurs as they prepare to source investment. With the amount of capital flowing into the province, our team wanted to share our take on the following questions – What does the current venture capital landscape look like in Alberta today and what will it look like tomorrow?

Recent VC Deals

Among the top ten disclosed Canadian deals in 2020, Alberta was represented by two rapidly scaling information technology companies. Coming in at the eighth spot was Jobber, an award-winning tracking and customer management software for home service businesses out of Edmonton that raised $76 million in a Series D round. Rounding out the top ten list was Symend, a digital engagement platform that assists customers with resolving overdue bill issues that is headquartered out of Calgary and that recently raised $73 million in a Series B round. These successful ventures are proof of what Albertan companies can accomplish when given access to the correct contacts and resources. Their successes are solidifying the idea that Alberta is an opportunity rich city for not just energy investments, but technology as well.

Sector Breakdown

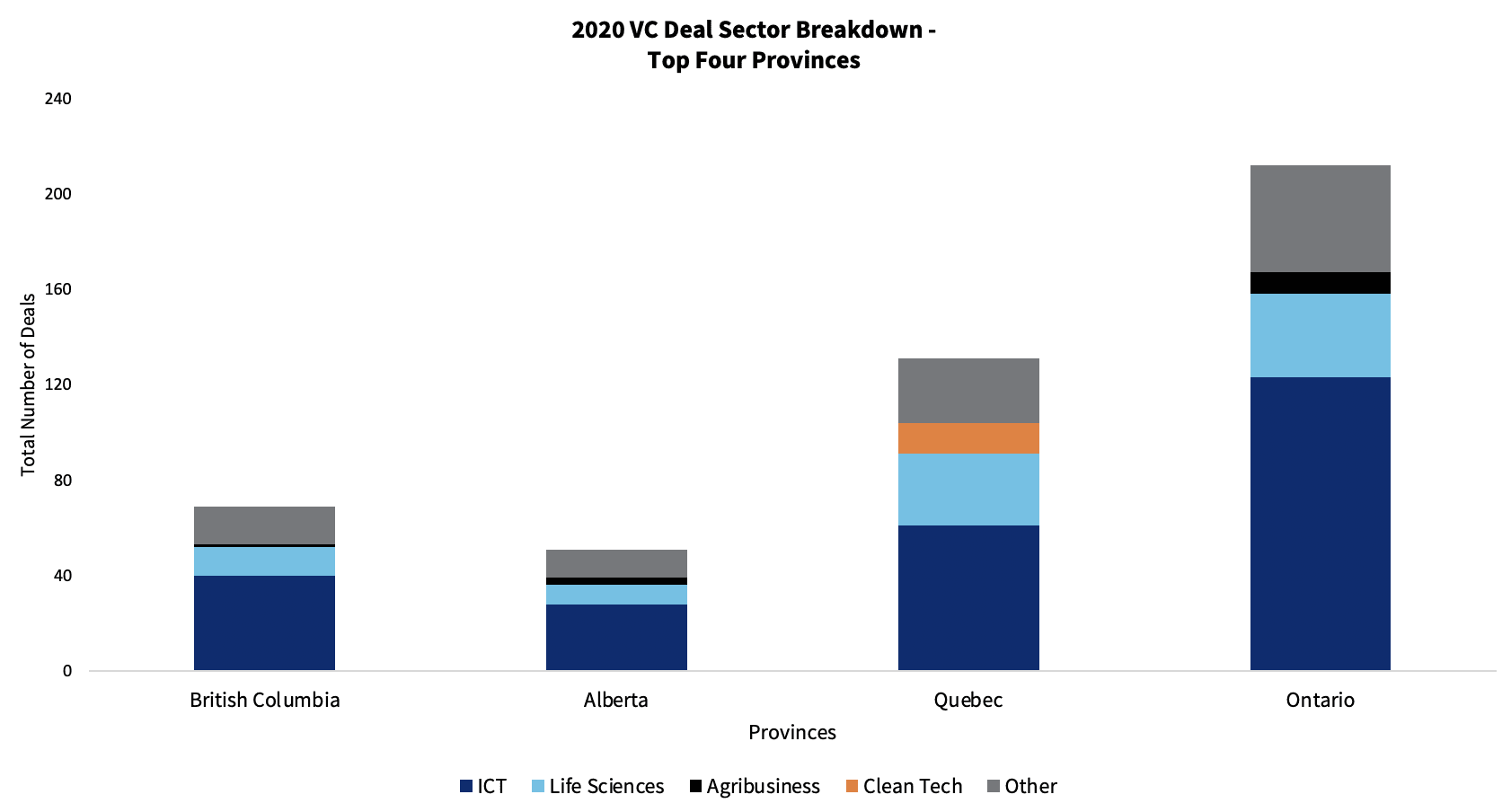

It is no secret that information, technology, and communication (ICT) ventures have been and will continue to attract large investment dollars. Alberta’s top three industry breakdown can be found in the below tables along with comparisons to other top Canadian provinces. One of the most intriguing takeaways is the lack of clean tech investments originating from Alberta and instead of the influx from areas such as Quebec. In line with this was that the overall Clean Tech sector saw a decrease from $400M in 2019 down to $101M in 2020. This is a trend that will likely be reversed going forward because of the increasing demand and adoption for renewable energy.

Future State

The investment ecosystem in Alberta is continually developing. The recent success of companies such as Symend and Jobber beyond their Series A will empower newer, younger companies looking to follow in their footsteps, but I believe the greatest opportunities for the province resides in the overlap between tech and energy which we are already seeing in 2021. Calgary companies such as Eavor secured over $50 million from large institutions like BDC Capital and BP Ventures in support of their carbon-neutral, geothermal solution. With the increasing number of organizations making clean energy commitments, it makes sense to look to Alberta, a leader in global energy, to leverage their infrastructure to lead the energy transition beginning with the venture space.

Discussion on the Later Stage Investments Focus

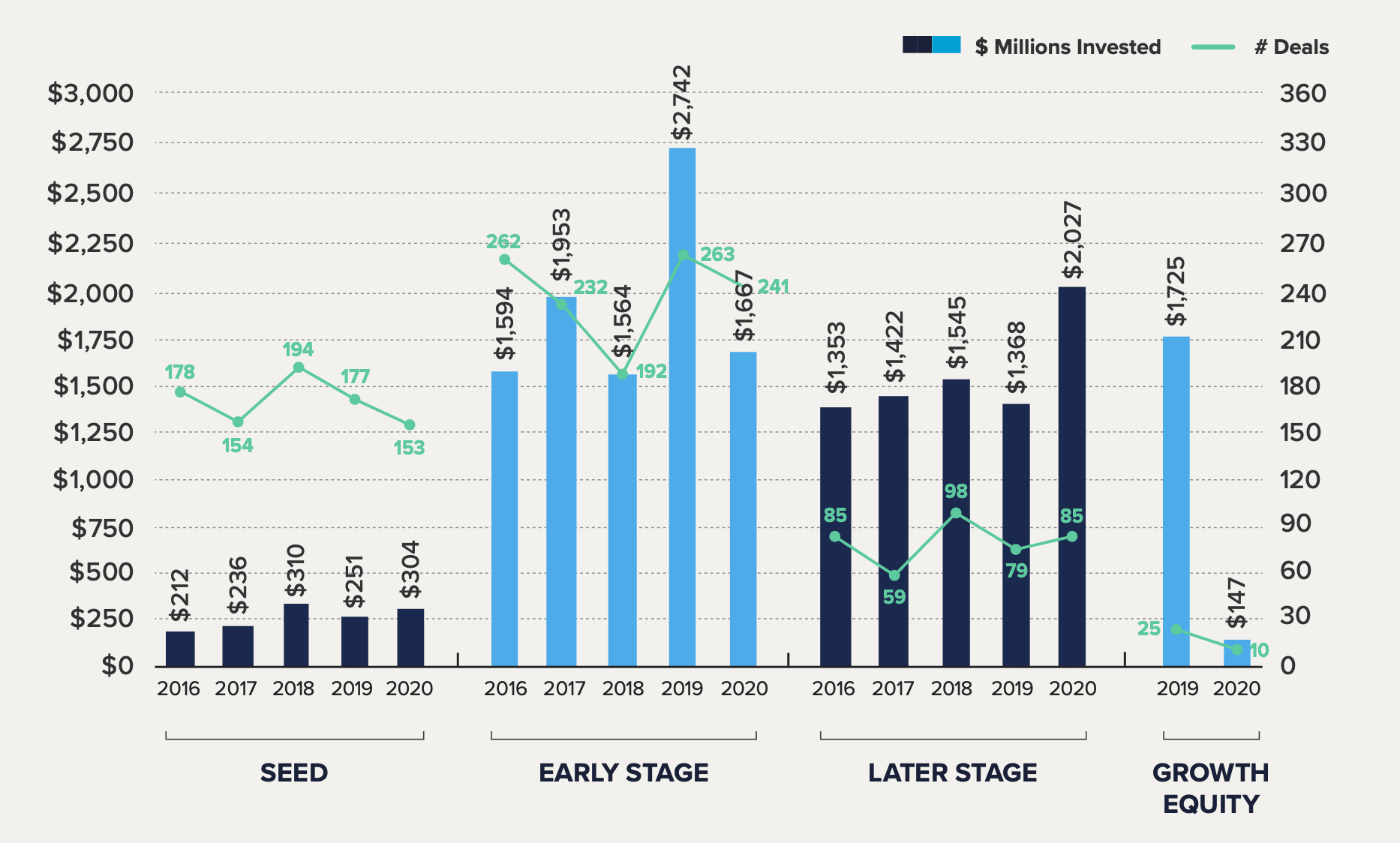

A topic that was not explicitly discussed in the CVCA report was the focus on investment successes within the later stages of venture investing. When venture capital is first brought up in discussion, the average person thinks very early-stage start-ups that can often be classified in angel/seed stage of funding, but all of the previously mentioned companies received commitments post-series A. Why does this matter? It matters because while the later-stage eco-system is attracting both investment and media attention, there still is an observed gap in the seed stage of the venture life cycle. Shown in the graph below, total seed stage deals declined 14% from 2019-2020, while the total dollar value of the deals increased slightly. I believe this provides an opportunity to extend additional support to ventures at arguably their most critical stage, leading to additional opportunities for later stage investors.

Challenges to Overcome

One of the biggest challenges facing Alberta is the attraction and retention of quality talent, which will be led by investors willing to support the ecosystem. If entrepreneurs understand that capital is available for the right ideas and right teams, then more will be encouraged to build businesses that can become staples in the local communities. An amazing example of this is Calgary’s very own, Benevity, who in late 2020 sold a majority stake of their social responsibility software for $1 billion. What we learned from their unicorn success story is that Calgary has the resources to build these success stories from the ground up.

Closing Thoughts

In summary, the VCAA and CVCA reports communicated valuable information about the venture capital landscape in Alberta and across Canada. With the information presented, it is now up to both entrepreneurs and investors alike to build on the $455 million invested in 509 total deals up by investing in high-quality, homegrown businesses. Recent traction and subsequent past success will serve as the foundation for future investments, all of which will move Alberta closer to achieving the ultimate goal - becoming the innovation hub for the Canadian venture capital landscape. Tailwind Ventures is proud to be actively contributing to this goal and looks forward to supporting entrepreneurs and startup companies as they make moves closer to achieving their dreams.